ETH Price Prediction: 2025-2040 Outlook Amid Technical Strength and Evolving Ecosystem

#ETH

- Technical Strength: MACD bullish divergence and institutional accumulation at $4.3K support level provide solid foundation for upward movement

- Ecosystem Development: Partnerships like MegaETH-Ethena and OpenSea's NFT initiatives drive utility and adoption growth

- Regulatory Integration: ETF developments and institutional participation creating new demand channels despite short-term outflow pressures

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Despite Short-Term Pressure

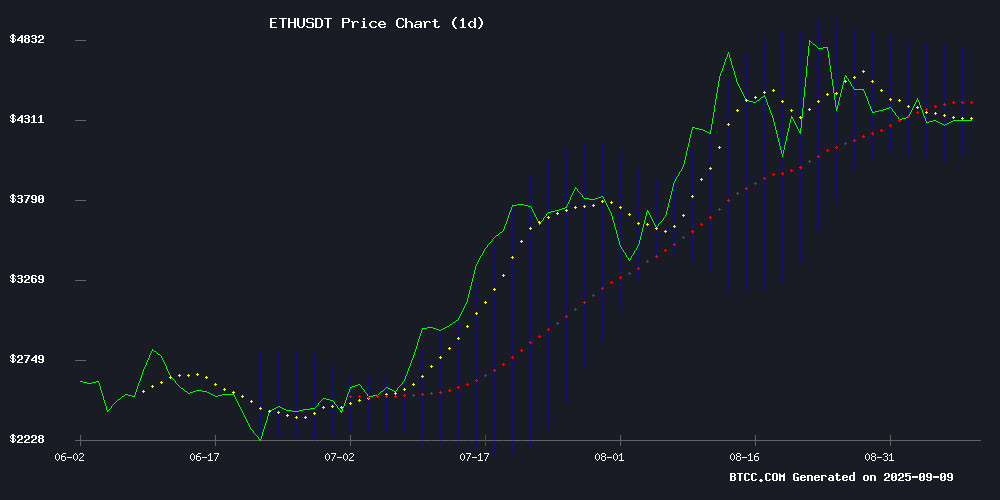

ETH is currently trading at $4,292.14, below its 20-day moving average of $4,430.52, indicating some near-term weakness. However, the MACD reading of 104.33 suggests strong bullish momentum remains intact. The Bollinger Bands show price trading closer to the middle band, with support at $4,074.74 and resistance at $4,786.29.

According to BTCC financial analyst Ava, "The technical setup suggests ETH is consolidating within a healthy range. The MACD divergence indicates underlying strength, and we expect a breakout above the $4,500 level once the current resistance is cleared."

Market Sentiment: Mixed Signals with Institutional Support Countering Short-Term Headwinds

Recent news flow presents a complex picture for Ethereum. Negative developments include $12M in scam losses from EIP-7702 exploits and selling pressure from BlackRock moves and ETF outflows. However, these are balanced by strong institutional accumulation supporting the $4.3K level and positive developments like OpenSea's $1M+ NFT archive launch and MegaETH's partnership with Ethena for reduced Layer 2 fees.

BTCC financial analyst Ava notes, "While short-term headwinds exist from exploit concerns and ETF outflows, the fundamental institutional support and ongoing ecosystem development provide a solid foundation for medium-term price appreciation. The $6K rally outlook remains plausible given current accumulation patterns."

Factors Influencing ETH's Price

Ethereum Scams Cost Investors $12M Amid EIP-7702 Exploits

Phishing scams targeting Ethereum users surged in August 2025, resulting in losses exceeding $12 million across more than 15,000 wallets. Blockchain security firm Scam Sniffer reported a 72% increase in losses from July, with the number of affected wallets rising by 67%.

The EIP-7702 upgrade, designed to enhance wallet functionality, has become a focal point for attackers. The standard allows externally owned accounts to temporarily operate like smart contract wallets, offering features such as batching transactions and setting spending limits. While these features aim to improve usability, they have been exploited to accelerate thefts.

Three whale wallets accounted for nearly 46% of the total losses, with one wallet losing over $3 million in a single incident. Security analysts warn that the convenience of EIP-7702 can backfire if users are not vigilant.

Ethereum Price Warning as Key Support Levels Face Breakdown

Ethereum's price is under pressure after a failed recovery attempt, now trading below $4,400 with heightened downside risks. Technical indicators suggest a potential slide toward $4,220 or lower unless bulls regain control.

The cryptocurrency briefly climbed past $4,350 and $4,400 resistance levels before encountering bearish pressure. A temporary floor formed near $4,233, but buying interest remains weak, with stiff resistance at $4,320.

A declining channel has emerged with resistance near $4,310, reinforced by the 100-hour Simple Moving Average. A close above $4,350 could spark a recovery toward $4,420, but failure to hold this level may accelerate declines.

OpenSea Launches $1M+ NFT Archive with Flagship Collection

OpenSea has unveiled its Flagship Collection, a $1 million initiative to acquire and curate culturally significant NFTs. The program, designed to highlight digital art as cultural artifacts, will operate under a committee-driven selection process. The first acquisition—CryptoPunk #5273—was purchased for 65 ETH (~$285K), signaling OpenSea's commitment to blending historical pieces with emerging artists' work.

The marketplace plans to celebrate each acquisition publicly, fostering dialogue within the collector community. Strict internal controls aim to prevent trading misuse. The move aligns with OpenSea's broader strategy ahead of its anticipated SEA token rollout.

Ethereum Holds $4.3K as Institutional Accumulation Fuels $6K Rally Outlook

Ethereum consolidates near $4,300, caught between immediate resistance at $4,500 and robust support at $4,200. The asset's 1% gain reflects cautious optimism as Tom Lee's BitMine Treasury amasses over 2 million ETH—a $8.5 billion bet on the network's long-term value.

On-chain metrics reveal accelerating accumulation, with $26 million worth of ETH withdrawn from exchanges this month. This mirrors growing institutional confidence ahead of potential ETF approvals, though technical indicators show neutral momentum for now.

MegaETH Partners with Ethena to Launch USDm Stablecoin, Aims to Reduce Layer 2 Fees

MegaETH is introducing a new economic model with the launch of USDm, a stablecoin designed to subsidize Layer 2 network operations. The stablecoin leverages yields from institutional-grade reserves, including BlackRock's tokenized treasury fund BUIDL, to offset costs and decouple revenue from user fees.

The collaboration with Ethena marks a strategic shift in blockchain economics. Unlike traditional Layer 2 chains that rely on transaction markups, USDm channels reserve yields to finance sequencer operations. This approach aims to stabilize fees while maintaining scalability as network throughput grows.

By aligning ecosystem growth with sustainable revenue streams, MegaETH seeks to address a fundamental flaw in current Layer 2 designs. The move could set a precedent for progressive blockchain economics, where user costs are minimized without compromising operational efficiency.

Ethereum Faces Selling Pressure Amid BlackRock Moves and ETF Outflows

Ethereum's price struggles intensify as institutional selling and weak market demand converge. The cryptocurrency has retreated from its late-August high near $4,950 to current levels around $4,330, with BlackRock's recent transfer of $312.5 million worth of ETH to Coinbase signaling potential liquidation. Simultaneously, the iShares Ethereum Trust recorded $309 million in outflows, compounding bearish sentiment.

Spot Ethereum ETFs mirrored this trend, hemorrhaging $446 million in a single day last week. While historical patterns show such outflows can reverse abruptly—as seen when August's $237 million exodus flipped to $1.08 billion inflows within weeks—current market dynamics lack the buying volume to stage a recovery. Daily charts reveal a concerning pattern of lower highs and failed tests at the $4,500 resistance level.

Sharplink's Ethereum Staking Plan Fails to Rally Investors

Sharplink's announcement to stake Ethereum on Linea's upcoming mainnet failed to impress investors, with SBET shares dropping 11% to $15.73. Market sentiment remains skeptical, as 82.5% of prediction market users on Myriad doubt the company will achieve its ambitious target of accumulating 1 million ETH by September 16.

The company's aggressive share issuance strategy to fund Ethereum purchases appears to be backfiring, diluting existing holdings and making the stock less attractive. With 837,230 ETH currently in treasury—worth approximately $3.62 billion—Sharplink faces growing pessimism about reaching its 7-figure ETH goal before the mid-September deadline.

Ethereum Price Poised for Significant Breakout Amid Strong Technicals and ETF Inflows

Ethereum's price has retreated from its year-to-date high of $4,945 to $4,335, yet analysts anticipate a robust bullish resurgence. The weekly chart reveals a critical retest of the $4,100 support level—a former resistance point—suggesting a potential springboard for upward momentum.

Market fundamentals reinforce this optimism. Spot ETH ETF inflows are climbing, and Ethereum continues to dominate key sectors like decentralized finance and non-fungible tokens. A successful hold above $4,100 could propel ETH toward its all-time high, with $5,000 and the $6,250 Murrey Math Line as subsequent targets.

The token remains 210% above its 2023 low, demonstrating resilience despite recent volatility. Only a breakdown below $4,100 would invalidate the current bullish thesis.

OpenSea Launches NFT Treasury with CryptoPunk Acquisition Ahead of SEA Token Launch

OpenSea has unveiled its 'Flagship Collection,' a curated NFT reserve beginning with CryptoPunk #5273—a $282,000 Ethereum-based asset acquired in August. The move signals the marketplace's strategic pivot toward preserving culturally significant digital artifacts as it prepares for its SEA token debut in early October.

The initiative coincides with OpenSea's final pre-token reward phase, featuring a $1 million prize pool denominated in ARB and OP tokens. CEO Devin Finzer frames the treasury as a long-term cultural vault: "We've always said NFTs are culture. The Flagship Collection is about picking the pieces we believe will stand the test of time."

Parallel developments include the rollout of an AI-powered mobile trading platform and confirmation that 50% of platform fees will fund future token and NFT rewards. The OpenSea Foundation's impending tokenomics reveal could recalibrate governance dynamics across the NFT ecosystem.

Ethereum Faces Resistance Near $4,900 as ETF Demand Cools

Ethereum traded at $4,330 on September 8, 2025, marking a 1% daily gain but a 2% weekly decline. The cryptocurrency's momentum has slowed as it approaches a critical resistance level near $4,900, following a strong rally earlier in the year.

Technical analyst Ted highlights Ethereum's proximity to its bull market support band between $3,246 and $3,486—a zone historically pivotal in uptrends. Declining ETF inflows suggest potential near-term downside, with a retest of $3,700-$3,800 likely before any renewed upward attempt.

The $4,500 level emerges as a key liquidity threshold. A liquidation heatmap reveals dense short positions clustered just above this price. A breakout could trigger a short squeeze, forcing traders to cover positions and potentially fueling a rapid price surge—a scenario market commentator Crypto Rover flagged as imminent.

Evolution of Digital Asset Treasuries (DATs) Through Transparency and Strategic Shifts

Digital Asset Treasury companies (DATs) continue to dominate industry conversations, with no signs of retreat or widespread collapse. The focus has shifted toward their evolution as vehicles for mobilizing traditional finance (TradFi) capital and deploying it onchain at scale. Yano, speaking on the Empire podcast, highlighted this potential transformation, questioning whether past over-leveraged blowups still haunt the sector.

Ethena Labs CEO Guy Young downplayed concerns for DATs collateralized one-to-one with target assets, citing transparency as a critical improvement. "The risk escalates when underlying assets are levered—like being 2x long ETH within the vehicle," Young noted. Unlike the opaque balance sheets of failed entities in 2021-2022, modern DATs face disclosure requirements, reducing systemic vulnerabilities.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators, market sentiment, and Ethereum's evolving ecosystem, here are our long-term price projections:

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $5,800 - $6,500 | ETF inflows, institutional adoption, EIP-7702 implementation |

| 2030 | $12,000 - $18,000 | Mass DeFi adoption, layer-2 scaling solutions, Web3 expansion |

| 2035 | $25,000 - $40,000 | Enterprise blockchain integration, tokenization of real-world assets |

| 2040 | $50,000 - $80,000+ | Global digital economy infrastructure, mature staking ecosystem |

BTCC financial analyst Ava emphasizes that "these projections assume continued network development, successful scaling solutions, and broader cryptocurrency adoption. Short-term volatility should be expected, but the long-term trajectory remains fundamentally bullish."